Calculate Net Operating Income Under Absorption Costing

Enter any losses or deductions as a negative value Answer is not complete. 13 Variable Costing Variable manufacturing costs only.

Absorption Costing Formula Calculation Of Absorption Costing

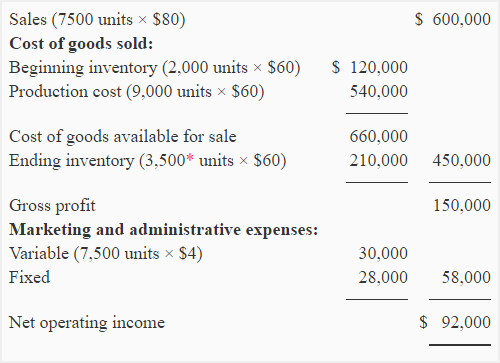

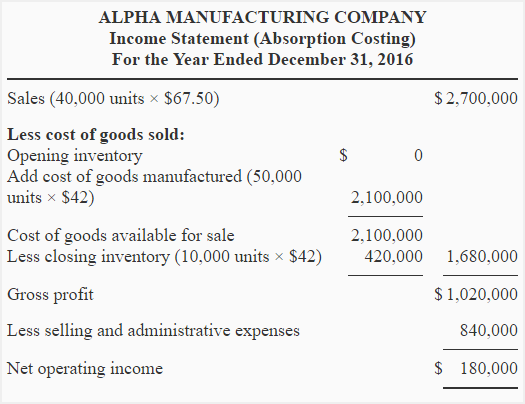

These traditional income statements use absorption costing to form an income statement.

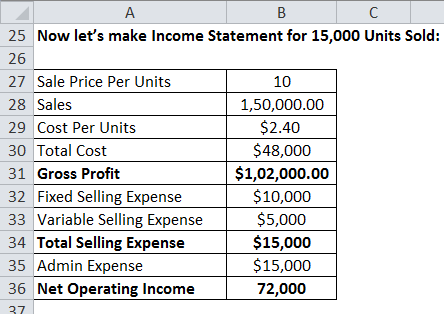

Calculate net operating income under absorption costing. Direct materials direct labor variable factory overhead and fixed factory overhead 121086. Operating income under absorption costing The cost of sales is computed by multiplying the product cost per unit by the number of units sold. Likewise what is the variable costing method.

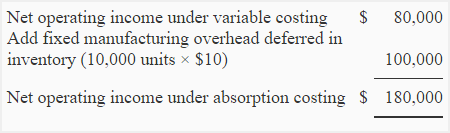

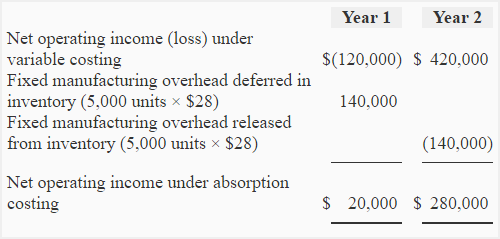

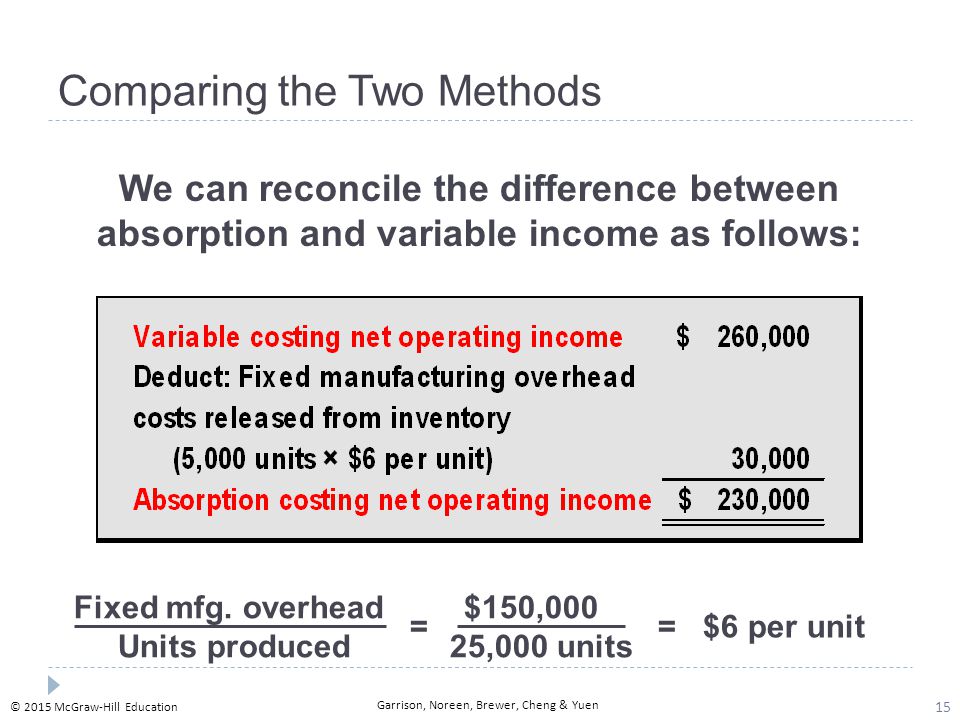

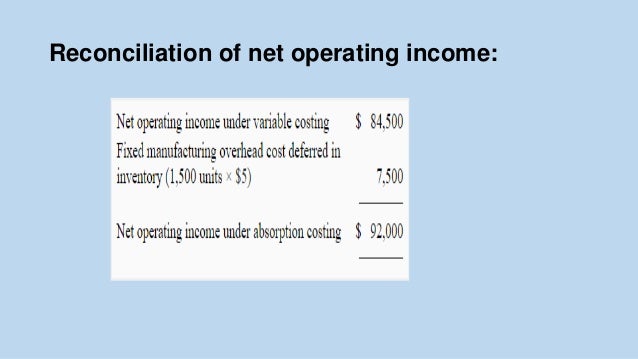

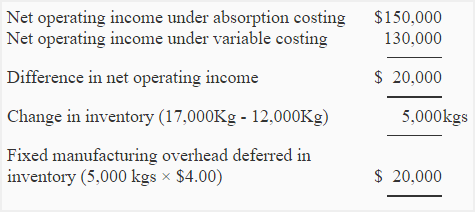

Calculate each years absorption costing net operating income. The product cost includes. The net operating income under absorption costing is 20000 more than the net operating income under variable costing.

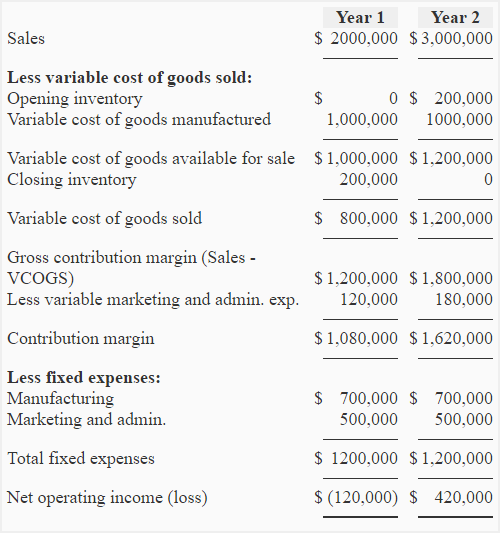

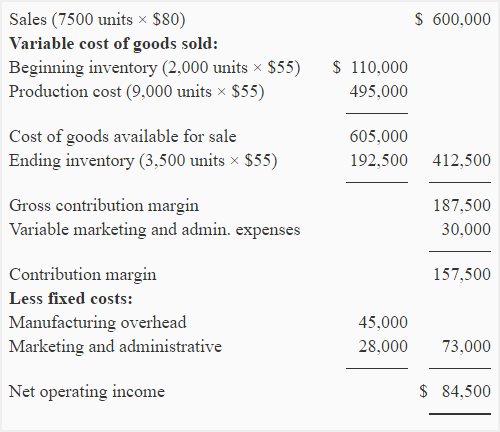

In comparing the two income statements for Bradley we notice that the cost of goods sold under absorption is 390 per unit and 330 per unit under variable costing. In absorption costing technique no difference is made between fixed and variable cost in calculating profits. Income Statement Under Absorption Costing Administrative selling and manufacturing costs are all separated into three categories by absorption costing.

Absorption costing net operating income will be less than variable costing net operating income. Fixed 100000 190000 Net operating income 230000 These are the 25000 units produced in the current period. Absorption Costing Absorption Costing Less cost of goods sold.

There is also a variable selling cost of 1 per unit and fixed selling cost of 2000 per month. Advantages of using variable costing and the contribution approach. What is the companys net operating income loss under absorption costing.

During the first two months Zambe expects the following levels of activity. The absorption costing income statement is also known as the traditional income statement. The difference represents net income for the current period.

Goods available for sale 480 000480000 Less ending inventory - 480000 Gross margin 420000 Less selling admin. Absorption costing is one of approach which is used for the purpose of valuation of inventory or calculation of the cost of the product in the company where all the expenses incurred by the company are taken into the consideration ie it includes all the direct and indirect expenses incurred by the company during the specific period. Fixed production overheads are budgeted at 20000 per month and average production is estimated to be 10000 units per month.

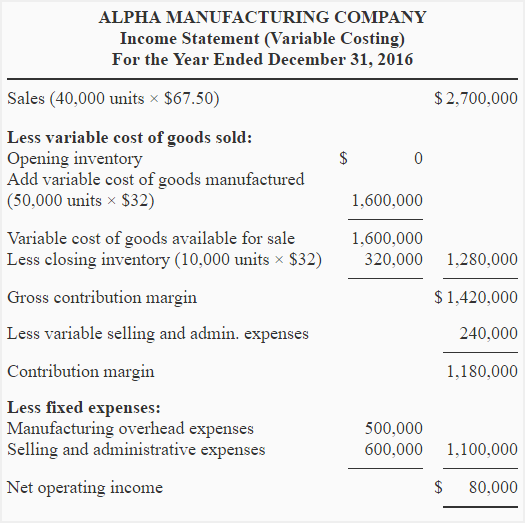

Remember the following under absorption costing. Calculate net income by subtracting the cost of goods sold and expenses from sales revenue. Under absorption costing the cost per unit is direct materials direct labor variable overhead and fixed overhead.

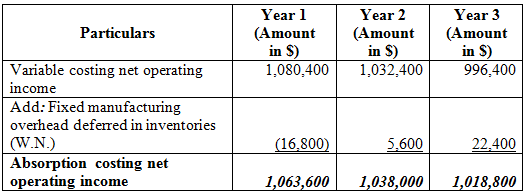

Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Year 1 Year 2 Year 3 Variable costing net operating income Add deduct fixed manufacturing overhead deferred. In this case the fixed overhead per unit is calculated by dividing total fixed overhead by the number of units produced see absorption costing post for details. Every other part of the income statement becomes easy to calculate once you have gotten your cost per unit.

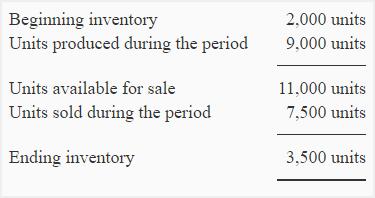

Net income under absorption costing can be reconciled with net income under variable costing by a subtracting the manufacturing overheads carried forward absorbed by closing inventories and b adding the manufacturing overheads brought in absorbed by opening inventories. Therefore the fixed manufacturing overhead cost deferred in inventory under absorption costing is 160000 as computed below. Under absorption costing net operating income can be _____ by changes in inventories.

In order to calculate gross margingross profit on sales in the income statement all production expenses both fixed and variable are deducted from the sales revenue. The selling price is fixed at 35 per unit. The income reported under each statement is off by 600 because of this difference 8100 under absorption and 7500 under variable.

Fixed manufacturing overhead costs are applied to units PRODUCED and not just unit sold. 5000 units 32 160000 128000040000 The amount of 160000 also represents the cause of difference of net operating income figure under two costing methods. Absorption costing also called full costing is what you are used to under Generally Accepted Accounting Principles.

This problem has been solved. Under absorption costing companies treat all manufacturing costs including both fixed and variable manufacturing costs as product costs. When production is more than sales as in this exercise the fixed manufacturing overhead is deferred in inventory that causes a higher net operating income under absorption costing than under variable costing.

Income statement shows Sales Cost of Goods sold Gross Margin or Gross Profit Operating Expenses Net Income and is based on the number of units SOLD. What is the amount of the difference between the variable costing and absorption costing net operating incomes losses. But marginal cost statement offers an alternative layout to the traditional income statement prepared under absorption costing.

Remember total variable costs change proportionately with. 63 Comparing Absorption and Variable Costing.

Exercise 2 Variable Costing Income Statement Reconciliation Of Net Operating Income Accounting For Management

1 What Is The Company S Total Gross Margin Under Chegg Com

Problem 1 Variable Costing Income Statement And Reconciliation Accounting For Management

Exercise 2 Variable Costing Income Statement Reconciliation Of Net Operating Income Accounting For Management

Problem 1 Variable Costing Income Statement And Reconciliation Accounting For Management

Causes Of Difference In Net Operating Income Under Variable And Absorption Costing Accounting For Management

Causes Of Difference In Net Operating Income Under Variable And Absorption Costing Accounting For Management

Causes Of Difference In Net Operating Income Under Variable And Absorption Costing Accounting For Management

Causes Of Difference In Net Operating Income Under Variable And Absorption Costing Accounting For Management

Exercise 2 Variable Costing Income Statement Reconciliation Of Net Operating Income Accounting For Management

7 1 Explain How Variable Costing Differs From Absorption Costing And Compute Unit Product Costs Under Each Method Learning Objective Number 1 Is To Explain Ppt Video Online Download

7 1 Explain How Variable Costing Differs From Absorption Costing And Compute Unit Product Costs Under Each Method Learning Objective Number 1 Is To Explain Ppt Video Online Download

Variable Costing Amp Absorption Costing

6 1 Variable Costing And Segment Reporting Tools

Exercise 5 Variable And Absorption Costing Income Statement Reconciliation Accounting For Management

6 3 Comparing Absorption And Variable Costing Managerial Accounting

Solved Reconciliation Of Absorption And Variable Costing Net Oper Chegg Com

Chapter7 140823230338 Phpapp01

Variable Costing A Tool For Management Ppt Video Online Download

Posting Komentar untuk "Calculate Net Operating Income Under Absorption Costing"