Net Salary Calculator Quebec 2020

Your average tax rate is 221 and your marginal tax rate is 349. If this is the case you may see a difference between your pay and the Payroll Deductions Online Calculator.

Https Www Canada Ca Content Dam Cra Arc Migration Cra Arc Tx Bsnss Tpcs Pyrll T4032 2020 T4032 Oc 1 20eng Pdf

The calculator is updated with the tax rates of all Canadian provinces and territories.

Net salary calculator quebec 2020. For example the basic personal amount is increasing from 15532 in 2020 to 15728 in 2021 15532 x 10126. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488. It is perfect for small business especially those new to doing payroll.

The Quebec Salary Calculator uses personal income tax rates from the following tax years 2021 is simply the default year for the Quebec salary calculator please note these income tax tables only include taxable elements allowances and thresholds used in the Canada Quebec Income Tax Calculator if you identify an error in the tax tables or a tax credit threshold that you would like us to add to the tax calculator. This places Canada on the 12th place in the International Labour Organisation statistics for 2012 after France but before Germany. Use this simple powerful tool whether your staff is paid salary or hourly and for every province or territory in Canada.

Enter your pay rate. Your average tax rate is 168 and your marginal tax rate is 269This marginal tax rate means that your immediate additional income will be taxed at this rate. Dutch Income Tax Calculator.

For the remainder of 2020 the CRA will expect this change to be implemented on a best efforts basis. The amount can be hourly daily weekly monthly or even annual earnings. That means that your net pay will be 40512 per year or 3376 per month.

This is required information only if you selected the hourly salary option. The payroll calculator from ADP is easy-to-use and FREE. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2020 income tax refund.

To calculate an annual salary multiply the gross pay by the number of pay periods per year. As a result your employer may be using a different Yukon Basic Personal Amount to calculate your pay. Please fill in all fields in the form Your gross monthly salary specified in your contract K month.

The latest budget information from April 2021 is used to show you exactly what you need to know. Of children Number of. You can use the calculator to compare your salaries between 2017 2018 2019 and 2020.

Enter the number of hours worked a week. This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Why not find your dream salary too. Net salary calculation Salary calculator 2021 Conversion of monthly gross income to net wage. Find your net pay for any salary with Net Salary Calculator in BC 2020.

7 rijen Income Tax Calculator Quebec 2020. This means that tax brackets and tax credits will increase by 126. Enter your annual salary to view a full Quebec tax calculation iCalculator also provides historical Canadian earning figures so individual employees and employers can review how much tax has been paid in previous tax years or you can use the salary calculator 202122 to see home much your take home salary will be in 2021.

The indexation factor for 2021 is 126 or 10126. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Hourly rates weekly pay and bonuses are also catered for.

Sweldong Pinoy is a salary calculator for Filipinos in computing net pay withholding taxes and contributions to SSSGSIS PhilHealth and PAG-IBIG. Enter the number of pay. The average monthly net salary in Canada is around 2 997 CAD with a minimum income of 1 012 CAD per month.

Quebecs personal income tax system is indexed against the Quebec consumer price index CPI. If you make CHF 50000 a year living in the region of Zurich Switzerland you will be taxed CHF 8399That means that your net pay will be CHF 41602 per year or CHF 3467 per month.

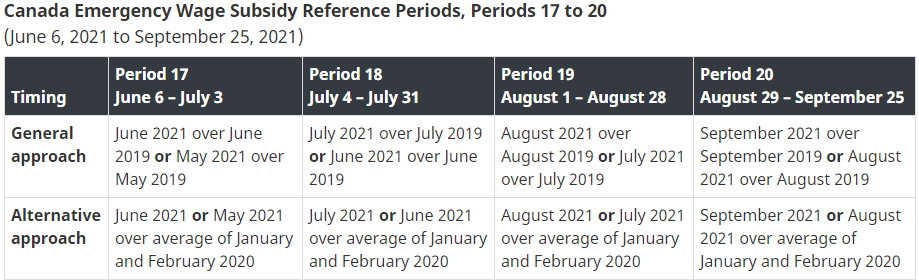

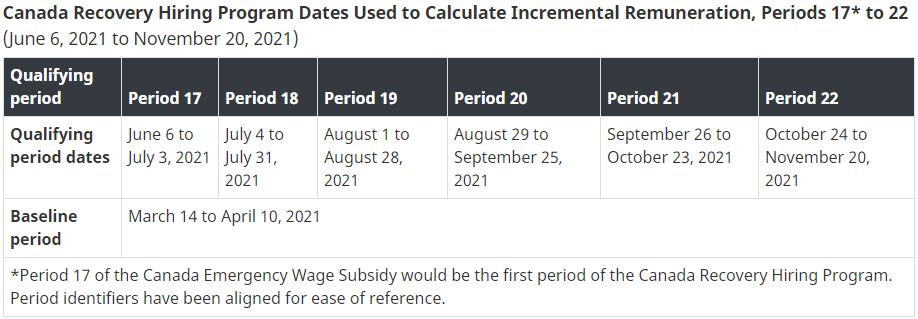

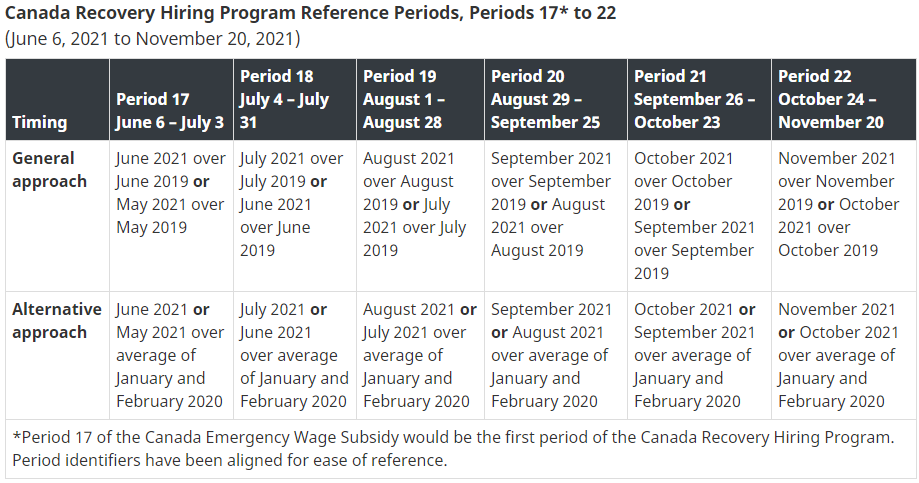

The Support Report Logan Katz Llp

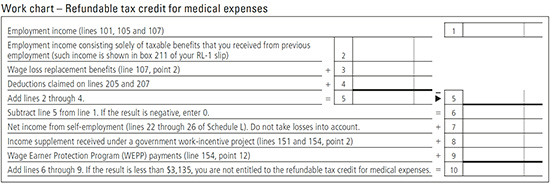

1 Refundable Tax Credit For Medical Expenses Line 462 Revenu Quebec

Income Replacement Indemnity For The First 14 Days Commission Des Normes De L Equite De La Sante Et De La Securite Du Travail Cnesst

The Support Report Logan Katz Llp

The Support Report Logan Katz Llp

What Kind Of Lifestyle Could I Afford In Toronto Earning 120k Cad Gross A Year Quora

Income Replacement Indemnity For The First 14 Days Commission Des Normes De L Equite De La Sante Et De La Securite Du Travail Cnesst

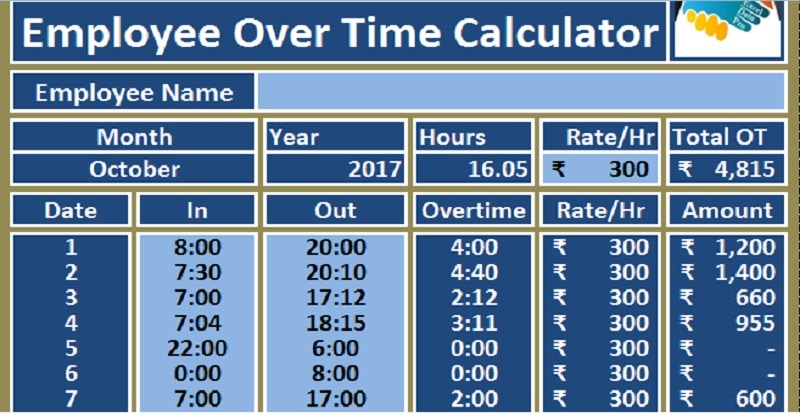

Download Employee Overtime Calculator Excel Template Exceldatapro

How To Calculate The Net Salary In A C Language Code To Calculate The N Coding Languages Coding Language

Canada In Imf Staff Country Reports Volume 2020 Issue 018 2020

2021 Manitoba Province Tax Calculator Canada

Income Replacement Indemnity For The First 14 Days Commission Des Normes De L Equite De La Sante Et De La Securite Du Travail Cnesst

Canada In Imf Staff Country Reports Volume 2020 Issue 018 2020

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

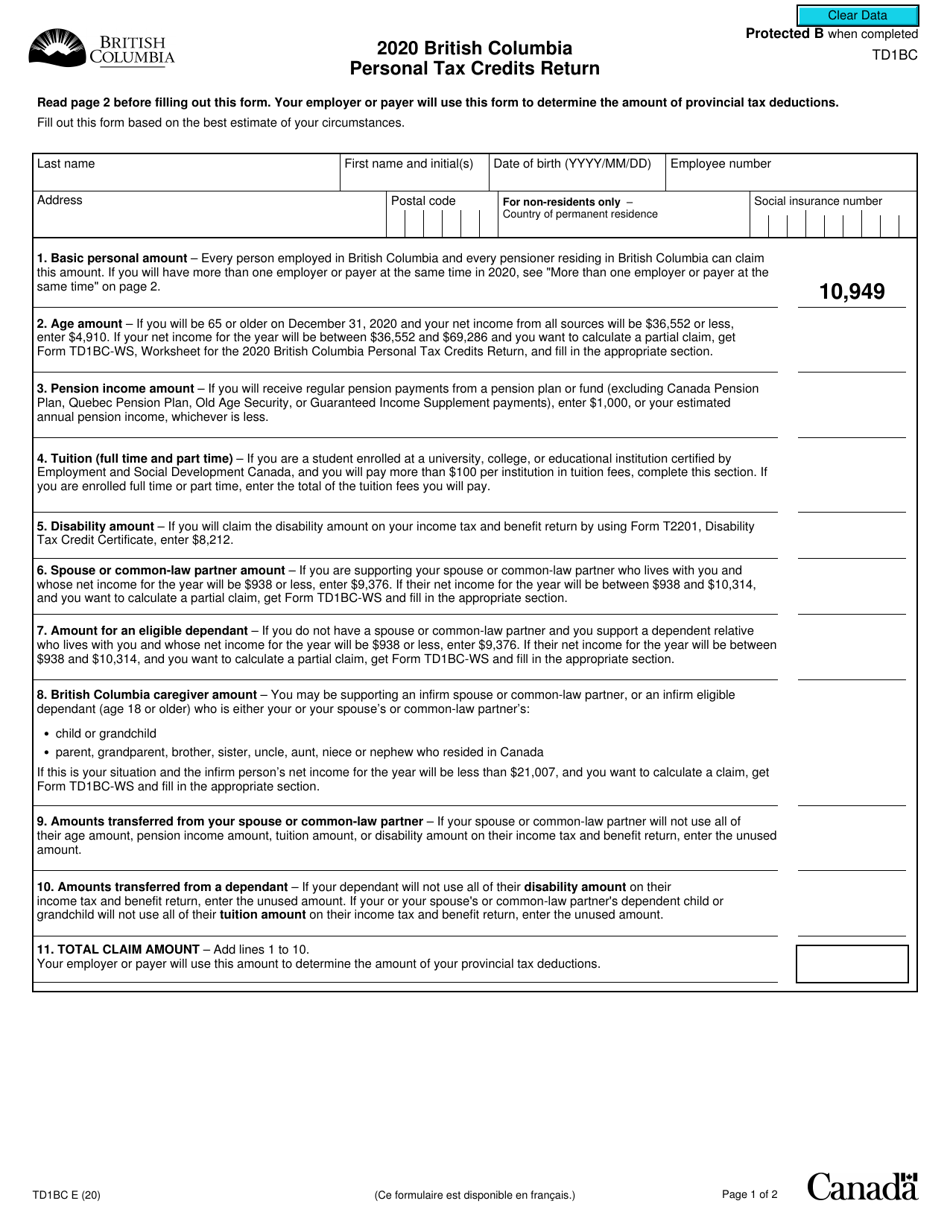

Form Td1bc Download Fillable Pdf Or Fill Online British Columbia Personal Tax Credits Return 2020 British Columbia Canada Templateroller

Simpletax Help Why Don T My Prior Year Losses Appear On My Return

Posting Komentar untuk "Net Salary Calculator Quebec 2020"