Gross To Net Income Calculator Quebec

Federal Tax Provincial Tax QPIP CPPQPP and EI premiums. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Mathematics For Work And Everyday Life

Use this simple powerful tool whether your staff is paid salary or hourly and for every province or territory in Canada.

Gross to net income calculator quebec. Basic personal amount in Quebec for year 2020 is 15532. On line 23 of Schedule L enter the net income or net loss resulting from the operation of a farming business. Formula for calculating net salary in BC Gross annual income Taxes CPP EI Net annual salary Net annual salary Weeks of work year Net weekly income Net weekly income Hours of work week Net hourly wage.

ADP Canada Canadian Payroll Calculator. The Quebec Income Tax Salary Calculator is updated 202122 tax year. The payroll calculator from ADP is easy-to-use and FREE.

Easy-to-use tax calculator for computing your net income in Canada after all taxes have been deducted from your gross income. Your average tax rate is 221 and your marginal tax rate is 349. 7 Zeilen Income Tax Calculator Quebec 2020.

130 dependent to your insurance company The half will be paid by the employer and the other half by the employee for both parts of the Health Insurance. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488. If your calculated income is less than 5000 and you have a spouse your premium payable is 334 of your calculated income or 501 plus 16700 if it is more than 5000 but less than 14601 with 5000 taken off of your calculated income.

The Table below illustrates how Quebec Income tax is calculated on a 4000000 annual salary. 2020 and 2021 Quebec Income Tax Calculator TaxTipsca Canadian Tax and Financial Information If you use. PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada.

Our Income Tax Calculator for Individuals works out your personal tax bill and marginal tax rates no matter where you reside in Canada. Canadian Payroll Calculator by PaymentEvolution. Net income before adjustments for calculation of clawbacks zero if negative - line 23400 Fed CRB clawback Clawback of EI and OAS Net income for tax purposes - line 236 Fed line 275 QC Net capital losses of other years after Oct 17 2000 Non-capital losses of other years.

To start complete the easy-to-follow form below. Canadas Federal Taxes are calculated using the latest Personal Income Tax Rates and Thresholds for Quebec in 2021. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location.

If you were a member of a partnership enter your share of the net income or of the net loss. Quebec provincial income tax rates 2020 In 2020 Quebec provincial income tax brackets and provincial base amount was increased by 19. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance.

Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related. Use our Income tax calculator to quickly estimate. If the salary of an employee is higher as a specific limit of 64350 the employee will be able to change into a private health insurance.

Income tax calculator takes into account the refundable federal tax abatement for Qubec residents and all federal tax rates are reduced by 165. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related tax allowances. On line 13 of Schedule L enter the gross income resulting from the operation of a farming business.

That means that your net pay will be 40512 per year or 3376 per month. If you were a. Gross Income for Tax Purposes.

Gross annual income - Taxes - Surtax - CPP - EI Net annual salary. Simply click on the year and enter your taxable income. The Quebec Income Tax Salary Calculator is updated 202122 tax year.

If you were a member of a partnership enter the partnerships gross income. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location. 146 of the Gross Wage as well as a additional contribution of approx.

It is perfect for small business especially those new to doing payroll.

Templates Examples Statement Of Earnings Template Template Examples F770d037 Resumesample Resumefor Statement Template Templates Templates Free Design

Confluence Mobile Community Wiki

How To Calculate Payroll Tax Deductions Monster Ca

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

2021 Quebec Province Tax Calculator Canada

Confluence Mobile Community Wiki

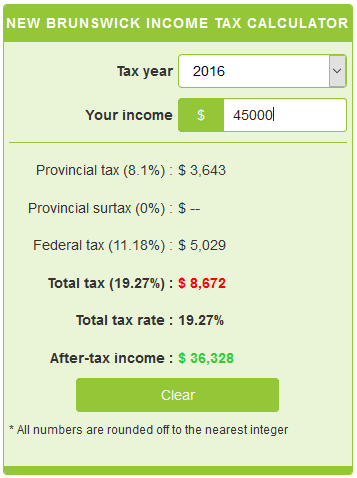

New Brunswick Income Tax Calculator Calculatorscanada Ca

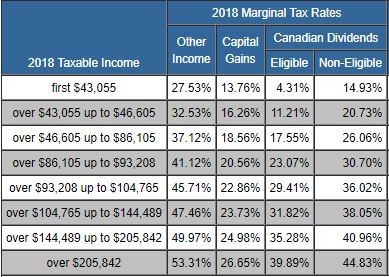

Taxtips Ca Quebec 2017 2018 Income Tax Rates

Investment Expense Deductibility Quebec Manulife Investment Management

Income Tax Calculator Calculatorscanada Ca

1 2 1 Understanding Your Pay Stub Canada Ca

Quebec Income Calculator 2020 2021

Https Www Payroll Ca Pdf Resources Guidelines Pay Statement Guidelines English Aspx

Line 101 Employment Income Revenu Quebec

How Can A Self Employed Person Calculate The Net Income Is There Any Formula We Can Refer To Parents In Quebec Babycenter Canada

Posting Komentar untuk "Gross To Net Income Calculator Quebec"