Can I Split My Mortgage Into Two Payments

Step 1 Find out if your bank allows biweekly mortgages. Some people also use tax refunds performance bonuses other similar streams to help create a 13th yearly payment.

How To Pay Off Your Mortgage Early 5 Simple Ways Forbes Advisor

Others choose to split because they want to set themselves.

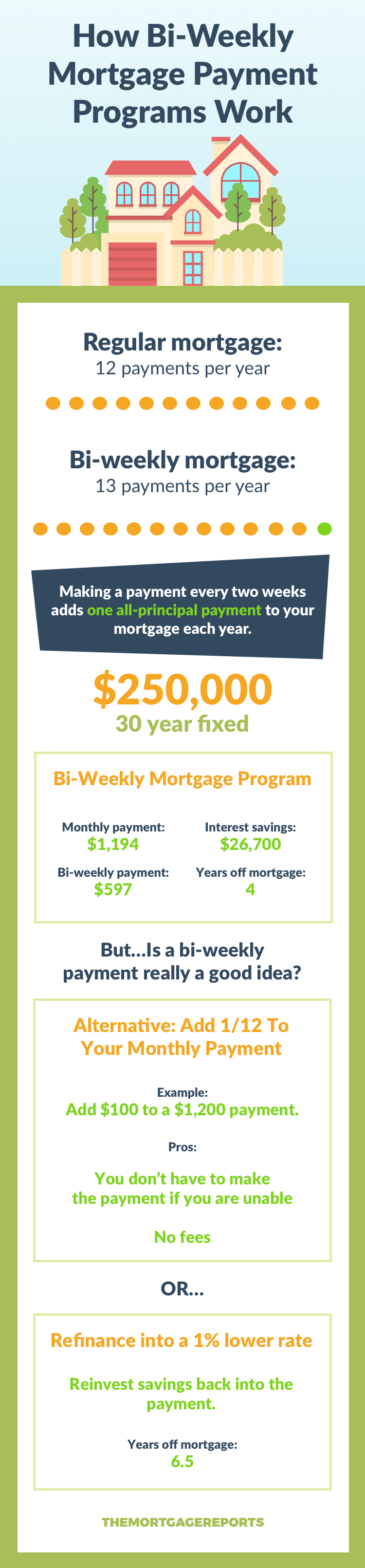

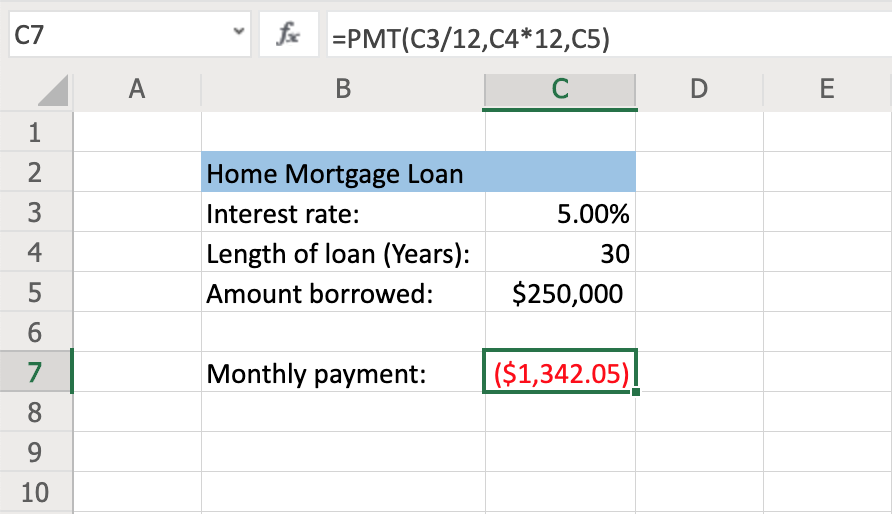

Can i split my mortgage into two payments. Lets say for example the current principal balance on your mortgage is 250000. Since there are 52 weeks in a year youd make 26 half payments and thus 13 full payments. Youd technically still be making your regular mortgage payment plus one smaller extra payment but the cumulative effect would be the same as if you were making biweekly payments automatically.

Its relatively simple to do. Splitting your house payment into two installments can help you pay off the mortgage faster. So when you split your monthly payment into two parts it doesnt reduce your.

Most home mortgages have monthly calculated interest. There is no concrete rule to how much you can split which means that you can split your mortgage by any amount you want. A semimonthly payment plan may be used to split your current monthly payment in half to yield a full payment each month.

Except when its not. This is known as a bi-weekly payment. For instance you can split the loan down the middle or 5050 or you can split it 20 variable and 80 fixed.

Next month you can make a payment of 125000 and the following month you can make another payment of 125000. You would need to make sure they apply the extra to the principal amount which would decrease how much you pay overtime. Sure youre thrilled to get the loan when you buy a house but to think it will be hanging over your head for the next 20 or 30 years is a bit daunting.

The split mortgage allows you to choose a split such as 3070 or 5050 to define the loan periods during which the interest rate is fixed or adjustable. If you decide to sell it of course you need their permission. Normally that would require the homeowner to make a monthly payment of 126414.

Over the course of a year this adds up to one extra full payment. Adjustments and Lender Margins. You have just split your mortgage into two payments.

Anyone can do this write Bach. Tens of thousands of dollars can be saved by making bi-weekly mortgage payments and enables the homeowner to pay off the mortgage almost eight years early with a savings of 23 of 30 of total interest costs. By using a bi-weekly payment plan the homeowner would pay 63207 every two weeks and in doing so cut six years of payments off of the mortgage loan and save 58747 off the total amount of the loan.

Therefore if your regular payment is 1500 a month you would pay 1625 each month instead. With the bi-weekly mortgage plan each year one additional mortgage payment is made. What you do is take the normal 30-year mortgage you have and instead of making the monthly payment the way you normally do you split it.

This plan will generate an additional mortgage payment each year and may. Dvide your monthly mortgage payment by 12 and make one principal-only extra mortgage payment for the resulting amount each month. Another option is to use 2 payments to pay more than the amount due such as paying 75 twice a month so you are paying 150 450 in this case per month.

Looking for help refinancing your mortgage. No matter what you do with it in the meantime say refinance it you need their permission. Mortgage payments under the ARM change when interest rates change.

Another method of doing this would be to simply make a payment equal to half of the amount of the monthly mortgage bill every two weeks. You can just divide your mortgage payment by 12 and add 112th the amount to your payment each month. If your partner decides to leave its all on you to make the payments and avoid default but your former partner still owns half the home.

Splitting allows them to take out the maximum interest-only loan and combine it with a capital repayment mortgage from the same lender. If you cant set up biweekly or twice-monthly payments but you can afford to pay a little more each month consider dividing the amount of your monthly payment by 12 and add that 112 amount as an extra payment marked apply to principal if your lender offers this option.

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Any Benefit Of Weekly Home Mortgage Payments Wsj

5 Ways To Pay Off Your Mortgage Early Pros And Cons

5 Types Of Private Mortgage Insurance Pmi

Biweekly Mortgage Payments How To Do Them For Free

How To Set Up Automatic Recurring Payments Freedom Mortgage

Bi Weekly Mortgage Program Are They Even Worth It

Should You Pay Your Mortgage Biweekly Pros And Cons Nextadvisor With Time

/dotdash-INV-final-Ways-to-Be-Mortgage-Free-Faster-Apr-2021-01-43a0ae096f8542a081344ba976221702.jpg)

Ways To Be Mortgage Free Faster

How Much A 100 000 Mortgage Will Cost You Credible

Mortgage Calculator How To Calculate Your Monthly Payments Valuepenguin

Mortgage Amortization How Your Mortgage Is Paid Off

Biweekly Mortgage Payments How To Do Them For Free The Truth About Mortgage

How To Calculate Monthly Loan Payments In Excel Investinganswers

Mortgage The Components Of A Mortgage Payment Wells Fargo

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Do Additional Principal Only Payments Help Rocket Mortgage

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Posting Komentar untuk "Can I Split My Mortgage Into Two Payments"