Adjusted Net Income Online Calculator

Gross operating income GOI 0 0. Part B calculates the Family Net Income.

Gross Income Formula Calculator Examples With Excel Template

Higher of 3600 or relevant earnings.

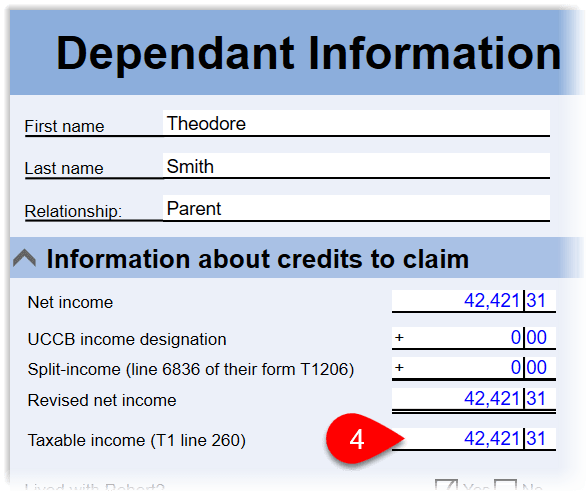

Adjusted net income online calculator. See line 453 in the General Income Tax and Benefit guide for 2021 for more information. 1 child under 6. It can also be used to estimate income tax for the coming year for 1040-ES filing planning ahead or comparison.

Aged 6 to 17 years of age. 50000 Private medical BIK. Subtracts the deduction from the income to figure out the AGI indicator.

Step 3 Calculates the WITB Disability Supplement. Step 2 - take off Gift Aid donations. X 7 Total reduction.

The stage where you calculate your adjusted gross income from your W2 is key for making sure you have all. Getting them right could mean paying less in income taxes than you would otherwise. Based on the standardized income conversion chart P1 has a net income of 3850.

If you made a Gift Aid donation take off the grossed-up amount - what you paid plus the basic. Gross operating income GOI operating expenses OE Conversions. Part A calculates the Working Income.

It is extremely easy to. This calculator computes your gross income and subtracts permitted adjustments to arrive at your AGI. This net income is then reduced by the grossed-up amount of the individuals gift contributions and the.

Please help me out here. AGI calculator or adjusted gross income calculator is a tool to estimate your adjusted gross income AGI which helps you determine your taxable income and tax bracket. To calculate adjusted net income you will need to look at a taxpayers total taxable income before personal allowances and then deduct any trading losses gift aid donations gross pension contributions and pension contributions where the pension provider has already provided tax relief at the basic rate.

The algorithm behind this adjusted gross income calculator performs the following steps. Locating and calculating your adjusted gross income using your W2 is especially important as that is where you factor in your deductions. Included in this are things like your salary rental income money from freelance work etc.

The starting point is net income which is the total of the individuals income subject to income tax less specified deductions the most important of which are trading losses and payments made gross to pension schemes. Adds all the amount form the deductions section. In order to work out adjusted net income you need to look at a taxpayers total taxable income before personal allowances and then deduct any trading losses gift aid donations gross pension contributions and pension contributions where the pension provider.

This is a freeview At a glance guide to Adjusted Net Income what is it and why it is relevant. Taxpayers are required to work out their Adjusted Net Income in order to calculate whether they are higher rate taxpayers for the purposes of the Personal savings allowance the High-Income Child Benefit charge the income-related reduction to. 5765 per year-Minus total reduction Your annual payment.

It will not be reduced if your threshold income for the current tax year is 200000 or less no matter what your adjusted income is. Solving for net operating income. Deductions are hopefully obviously pretty good.

Their combined adjusted. An adjusted family net income of 45000. I am really nervous about the F6 exam and I am trying.

Determining Adjusted Net Income. P2 has a net income of 3759. Net operating income NOI HAS NOT BEEN CALCULATED.

Operating expenses OE 0 0. Under 6 years of age. The other income field refers to any other income such as income.

A table showing the Adjusted family net income levels is displayed underneath the calculator. 1 Gross amounts of personal pension contributions PAID during the tax year or 2 Gross amounts of personal pension contributions PAID THAT ATTRACTS TAX RELIEF ie. Adjusted family net income-32028 Income over threshold.

I am trying to calculate my adjusted net income to ensure I do not fall foul of the child benefit charge. When calculating adjusted net income which one of the following do we deduct from the net income. Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors.

The calculation of adjusted net income begins as its name implies with net incomeNet income is the sum total of all revenue expenses debts taxes interest. I believe there is some sort of relief as a higher rate tax payer on the additional 20 - I was just going to let. Extending this further let us show you an instance of how to calculate AGI.

Adds all the values from the income sources specified. Net Operating Income NOI Calculator Investment Real Estate Property Residential Commercial Industrial Equations Formulas. It not only determines your tax bracket but also tells you which credits you.

What is Adjusted Net Income. Your net income is then adjusted - steps 2 to 4 below. The child lives with P1.

Penalties paid if any for withdrawing early from your savings account. Second the two net incomes are added together to find the parents combined adjusted net income. Step 2 Calculates the Basic WITB.

Your adjusted net income is your total taxable income. Explore many more calculators on tax finance math fitness health and more. In regard of the data you may need to specify please note that.

400 So Gross income 50400 I make pension contributions from net income which is grossed up by the pension scheme 20. Retirement account contributions Health savings account deductions 50 of the taxes paid for self-employment like Social Security Taxes Medicare Taxes etc. Adjusted net income is calculated in a series of steps.

For every 2 your adjusted income. Your Personal Allowance is the first 12570 of. But just to make things confusing your Personal Allowance is included.

Adjusted gross income AGI or your income minus deductions is important when calculating your total tax liability. Not included in this total are tax reliefs like losses from previous years pensions contributions or donations to charities. Example Parent 1 P1 and Parent 2 P2 each have a gross monthly income of 5000.

7 of your income greater than 32028. Calculate this concerning your net self-employment income.

T1206 Tax On Split Income Tosi Taxcycle

Salary Calculator Hourly Monthly Annual Income Calculator

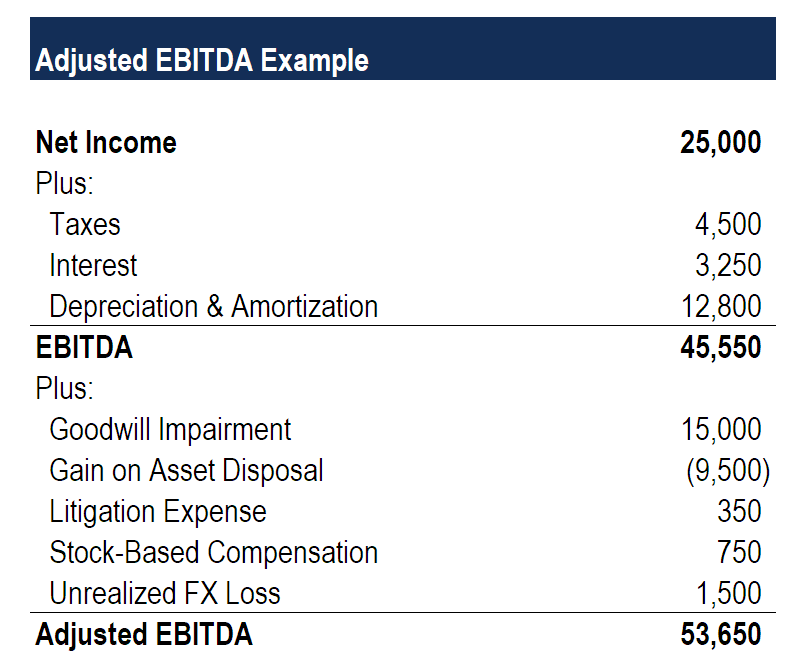

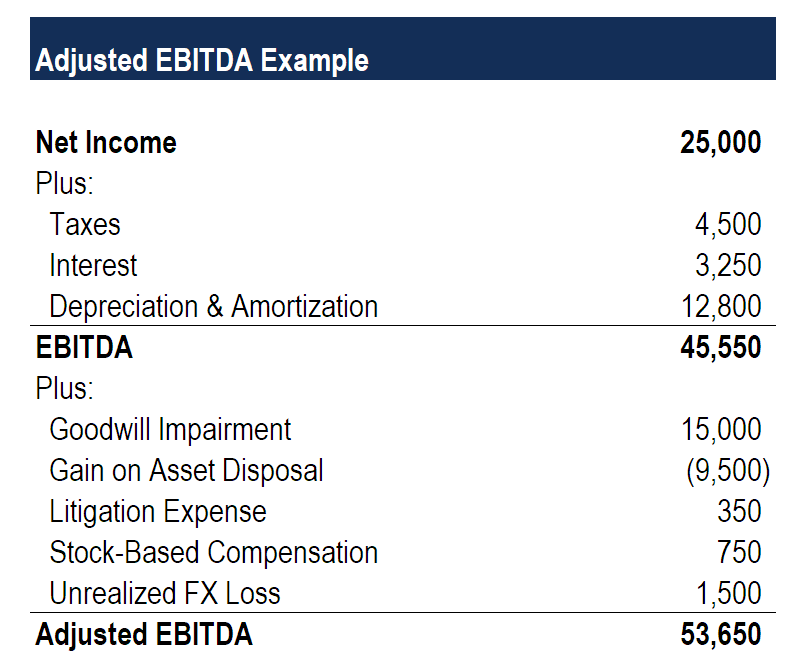

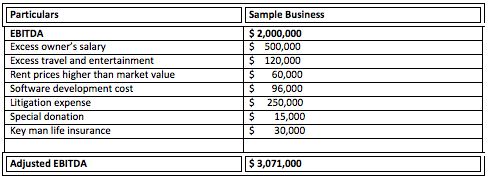

Adjusted Ebitda Overview How To Calculate Adjusted Ebitda

Taxable Income Formula Calculator Examples With Excel Template

Calculating Net Profit After Tax And Why It Is The 1 Metric For Business

Taxable Income Formula Calculator Examples With Excel Template

Agi Calculator Calculate Adjusted Gross Income Taxact

Self Employed Calculate Your Quarterly Estimated Income Tax Xendoo

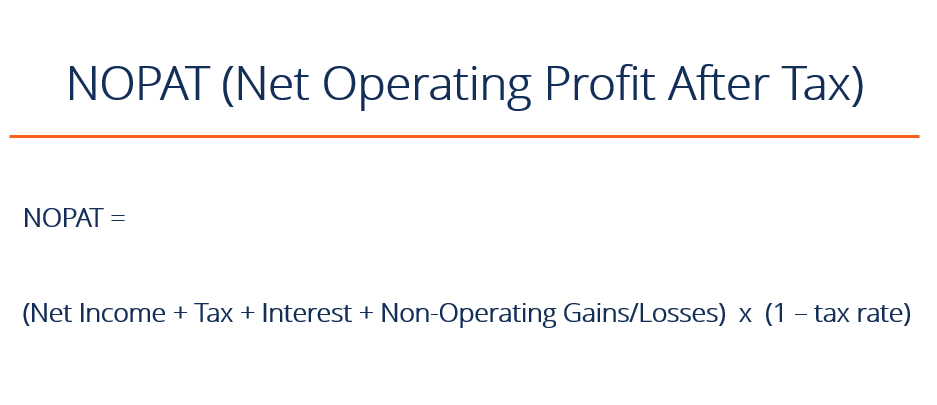

Nopat Net Operating Profit After Tax What You Need To Know

Net Income Example Formula Meaning Investinganswers

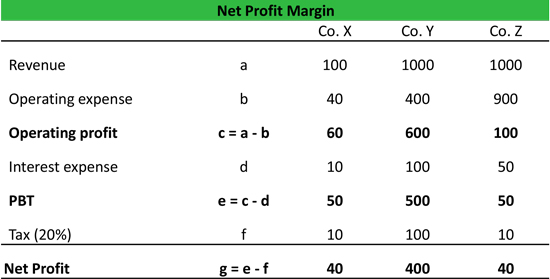

Net Profit Margin Formula Example Calculation

Gross Income Formula Calculator Examples With Excel Template

60 Tax Relief On Pension Contributions Royal London For Advisers

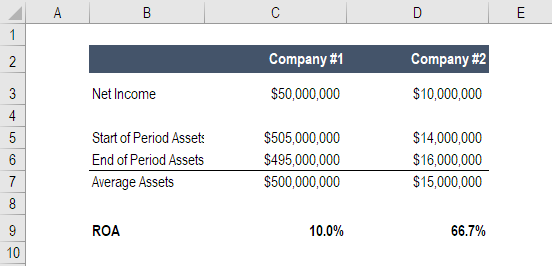

Return On Assets Roa Formula Calculation And Examples

Adjusted Net Income Taxscouts Taxopedia

Adjusted Ebitda Definition Adjusted Ebitda Margin Calculation

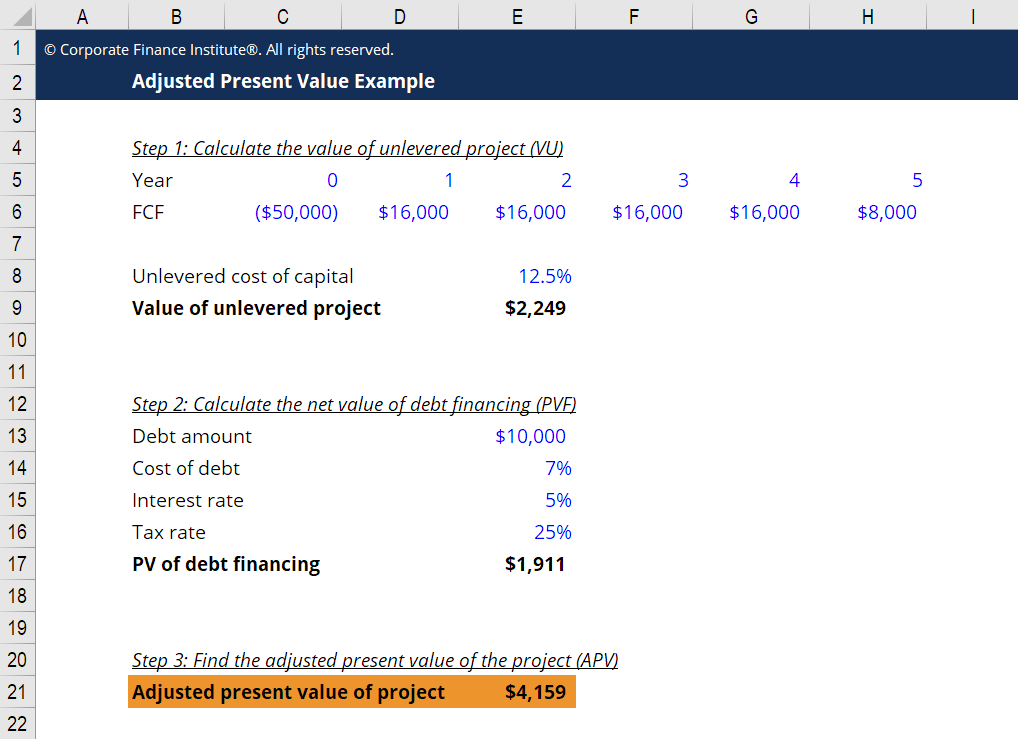

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Profit Improvement Calculator Plan Projections How To Plan Profitable Business Things To Sell

Posting Komentar untuk "Adjusted Net Income Online Calculator"